Tax returns have been due in on July 2015, however given the circumstances, the federal authorities have supplied a 3 month extension. Regardless of this, commentators nonetheless count on as much as 1.4m to fail to offer a return, which CNBC observe will end in a 5% cost and – worse – funds that might be redistributed to the taxpayer being withheld by the IRS. Taxes is usually a troublesome course of, however with somewhat planning and dedication, they are often made straightforward. On the coronary heart of those preparations is a straightforward, however essential, idea – paperwork.

The fundamentals – W2 and 1099-G

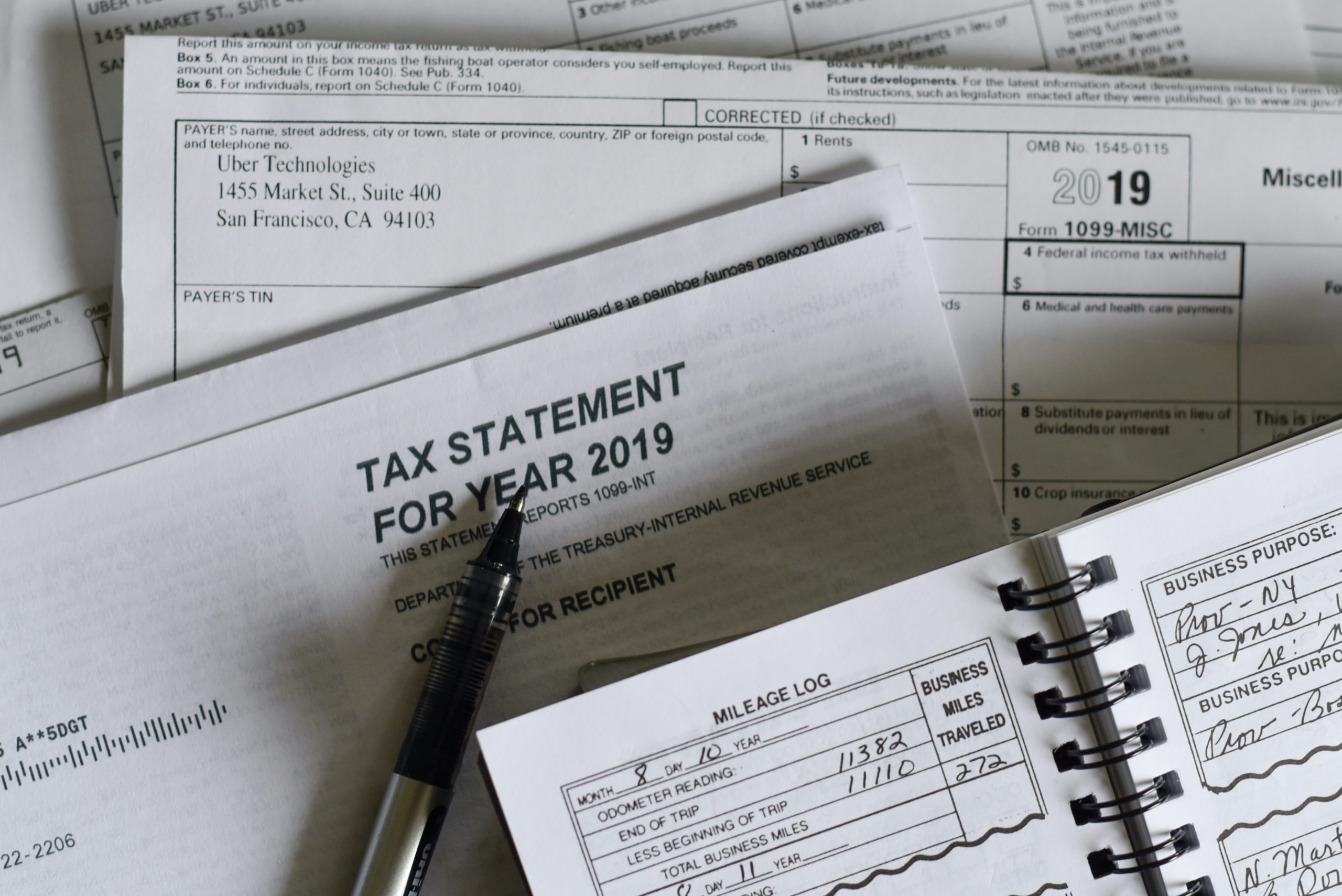

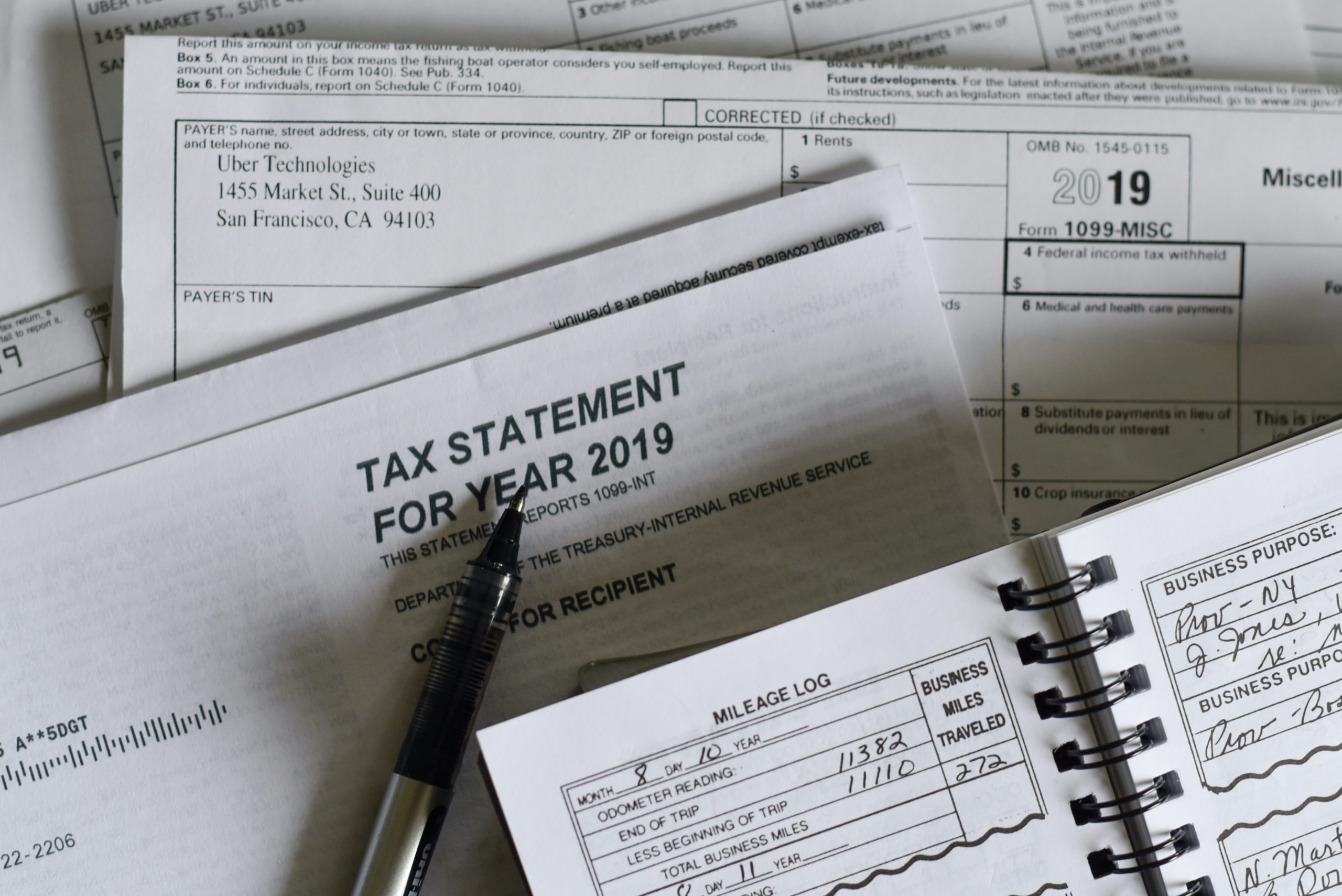

Apart out of your primary particulars – title, deal with, social safety – absolutely the must-have doc, supported by proof all year long, is the W2 (for employed individuals) and the 1099-G (for unemployed individuals). Whereas these change in want from case to case, and self-employed professions would require additional proof, they do present the premise for revenue assessments. While you obtain this kind out of your employer, or begin filling it out your self as a self-employed individual, use your time to diligently verify for errors. In response to US Information, the correction course of when amending these varieties could be time-consuming and dear for each the IRS and taxpayer – get it proper first time.

Distinctive revenue

Maintain a thought for any revenue you will have made by way of non-formal employment. This will embrace hobbies, on-line promoting and playing. To take the latter, Investopedia define how playing revenue could be taxed – something over $1,200 ought to be issued a type when paid out by the on line casino in query. If not, the gambler should nonetheless report all the things to the IRS. Maintain an eye fixed out for these small sums which, over time, can add as much as a notable untaxed pot. It’ll enhance the accuracy of your report and maintain you out of the radar of IRS investigators, in the end resulting in your tax affairs being so as and well timed.

Securing your dues

Apart from the authorized requirement to fill out tax returns, the method of tax evaluation can present substantial financial savings. Deductions can vary from Ok-12 educator bills and charitable donations by way of to federally declared catastrophe rebates and residential enhancements for vitality financial savings subsidies. Primarily, there’s a enormous vary of issues you possibly can undertake in each day life that the federal government will permit you a refund for. One of the best ways to maintain organized right here is to maintain paperwork regarding any modifications or purchases you make to help the house or enterprise; in comparison towards the rebate textual content and standards, it’s possible you’ll be owed prices that you wouldn’t have picked up on in any other case. There isn’t any legislation towards making the request in good religion, even when the IRS deny it.

Cautious administration of your tax affairs is essential to your long-term monetary well being and may, certainly, have an effect in your psychological and bodily well being. Having thorough documentation to help your tax course of is vital on this. Maintain your paperwork; make your self conscious of your rights; and be well timed in your submitting course of.