An effective way to economize is to refinance your paid off automobile at a low charge and use the cash to repay money owed with greater rates of interest. You reap the benefits of the low value cash by cashing out $10,000 or $20,000 at 1.99% to pay different money owed reminiscent of scholar loans, mortgages and bank card money owed. That’s a really fast and simple technique to make revenue and lower your expenses with this arbitrage methodology. Don’t fear! I’ll present you step-by-step on the way to refinance a paid off automobile.

Actual-Life Instance for Money-Out Refinance on a Paid Off Automotive

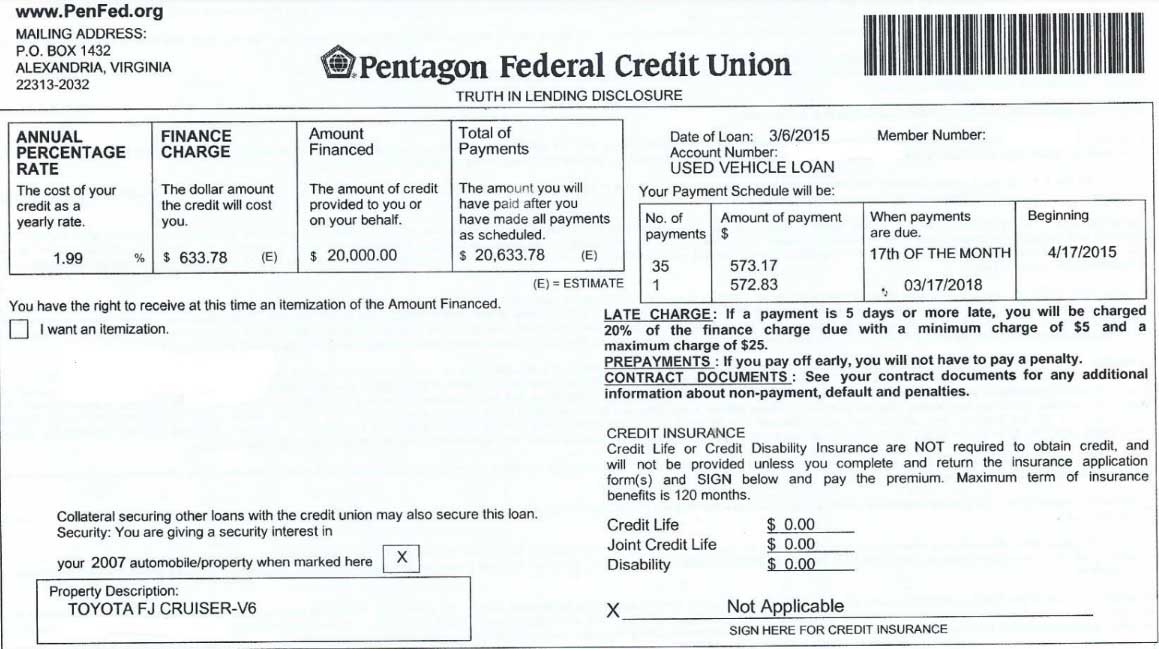

My spouse and I personal two automobiles outright. Throughout my journey to be fully debt free, I’ve used this nice arbitrage twice to refinance a paid off automobile, in 2012 for my Toyota Camry and in 2015 for my Toyota FJ Cruiser. See the next image about Reality in Lending Disclosure for proof:

I effortlessly obtained $20,000 test for my paid off 2007 automobile after mailing out the title to the financial institution (on this case it’s Pentagon Federal Credit score Union). There’s additionally no price to refinance my paid off automobile. I used all of $20,000 at 1.99% rate of interest to pay down my mortgage at a a lot greater charge. Straightforward revenue!

In the event you marvel why get into debt when you have already got a paid off automobile. It will depend on what you do with the cash you obtain from the automobile refinance. Please don’t do this methodology for those who’re going to waste all the cash away, as a substitute of paying down your different greater curiosity money owed.

Cash is fungible so it doesn’t matter if the mortgage is in your automobile or your home. You need to pay the bottom charge potential in your money owed. It’d sound unusual however entering into debt–by refinancing my paid off automobile–helps me to get out of money owed faster. No joking!

I’ll now present you the way to reap the benefits of this rate of interest arbitrage by refinancing your paid off automobile.

Steps to Refinance Your Paid Off Automotive

First, contact your credit score union about an used automobile mortgage. Most credit score unions will allow you to refinance a paid off automobile. In my case, Pentagon Federal Credit score Union (Penfed) has an used auto mortgage with 1.99% APR as much as $100,000 on their web site.

Subsequent, decide how a lot you need to money out out of your paid off automobile. PenFed will mortgage you as much as the NADA retail worth. You possibly can test on NADA web site to see how a lot your paid off automobile is value. If you’re undecided how a lot to take out in your used automobile, you’ll be able to name to ask the max worth after your auto mortgage is accepted. For my 2007 automobile, I used $20,000 as the worth after I utilized in 2015.

Then go surfing to PenFed or your Credit score Union web site and apply for a refinance auto mortgage with 1.99% APR to covert a chunk of paper (title) from a automobile that you just personal outright into money. I did it twice with each of my automobiles that I personal outright. I even received a diminished charge of 1.49% and used the cash to efficiently speed up my get-out-of-debt plan.

When your auto mortgage is conditionally accepted, you should scan and e mail them the back and front your lien-free title. In my case, I simply connected and emailed the copy of a lien-free title to information@hq.penfed.org together with the auto mortgage quantity. PenFed will reply again that they’ve obtained the attachments and the copies of the lien-free title have been forwarded to the suitable celebration for overview. Whereas the mortgage division is reviewing, you’ll be able to test the mortgage standing on-line by viewing the prevailing software.

As soon as your refinance has been formally accepted, your test will come within the mail. Congrats!

Don’t neglect to bodily mail the title to the lender. That’s it. It’s properly definitely worth the effort to refinance your paid off automobile in case you have different money owed with greater rates of interest to pay.

Further Thought

By refinancing your paid off automobile and utilizing the cash to pay your different money owed, you’ll be able to simply save a whole lot or 1000’s of {dollars} over the lifetime of the mortgage. You don’t have to supply any rationalization to the financial institution on why you need the cash out of your automobile. They mail you the test, and also you mail them the title. Truthful and sq..

If in case you have excessive curiosity money owed reminiscent of a scholar mortgage and you’ve got a paid off automobile that’s value $20,000, why not get a cash-out refinance mortgage and borrow $15,000 to repay your scholar mortgage at 6%. This arbitrage methodology is a superb technique to repay excessive curiosity bank card money owed and even mortgage. You possibly can preserve all of the saving in your pocket as a substitute of giving it to the mortgage suppliers.

When you repay the mortgage, does the financial institution ship you again the title? Sure, I received my title again from PenFed within the mail as soon as the mortgage was paid off. These days I don’t have any money owed after I paid all of them off in 2016.

For me, the method to refinance my paid off automobile was very simple. Your entire course of was all on-line and by way of e mail when PenFed accepted my 1.99% auto mortgage for 5 years with $0 price. After every week, I obtained the test and used it to pay one other higher-interest mortgage, ie. mortgage.

For people who nonetheless have money owed on the market, refinancing your paid off automobile is a good way to economize whereas making an attempt to do away with money owed.

Often Requested Questions on Refinancing a Paid Off Automotive

By refinancing a paid off automobile to repay different money owed, it can save you cash and get out of debt sooner. Listed here are some regularly requested questions that you just may need:

1. Why do you have to refinance your paid off automobile?

You possibly can reap the benefits of decrease your rate of interest and repay your different loans for much less cash. Decrease rates of interest imply decrease funds and extra money that can assist you towards monetary freedom. It is best to apply the cash you obtain via refinancing to your new mortgage and repay your debt sooner.

2. How does refinancing a paid off automobile work?

Refinancing a paid off automobile signifies that you’ll obtain cash for what your automobile is value. In return, you switch your automobile’s title to the financial institution as the brand new lien holder. The entire course of could be very easy and cheap. Your new mortgage can be at a decrease rate of interest than your different money owed. By benefiting from refinancing a paid off automobile, you need to use the cash to get out of upper interest-rate money owed a lot sooner.

3. How do I apply for refinancing a paid off automobile?

Merely full a web-based software your financial institution or credit score union like PenFed. The method is fast and simple. As soon as your mortgage is accepted, the financial institution will ship you a test.

4. What do I have to qualify for refinancing a paid off automobile?

You should be eligible for membership at Pentagon Federal Credit score Union or your most popular credit score union. You should be the proprietor of the paid off automobile and have the clear title helpful.

5. Does it value cash to refinance a paid off automobile?

The refinance charges are minimal. For PenFed, you’ll be able to refinance a paid off automobile without cost. Over the long term, the cash that you just save after benefiting from the low charge to pay different money owed can be large.

6. What automobile can I refinance?

Nearly any vehicles that you just personal outright. You possibly can refinance your paid off automobiles and use the cash to repay the next charge mortgage or bank card and lower your expenses. Your automobile can be used as a collateral and the financial institution would be the new lien holder. When you get rid off different money owed, you’ll be able to repay your automobile mortgage to obtain the title again.

7. What’s the largest quantity I can refinance a paid off automobile?

The utmost mortgage quantity is relying on automobile’s retail worth. As an illustration, PenFed will mortgage you as much as the NADA retail worth.

8. How lengthy does the refinancing a paid off automobile take?

Usually it takes every week, however the course of might be sooner relying in your circumstances. All through the method you’ll be able to monitor the progress on-line.