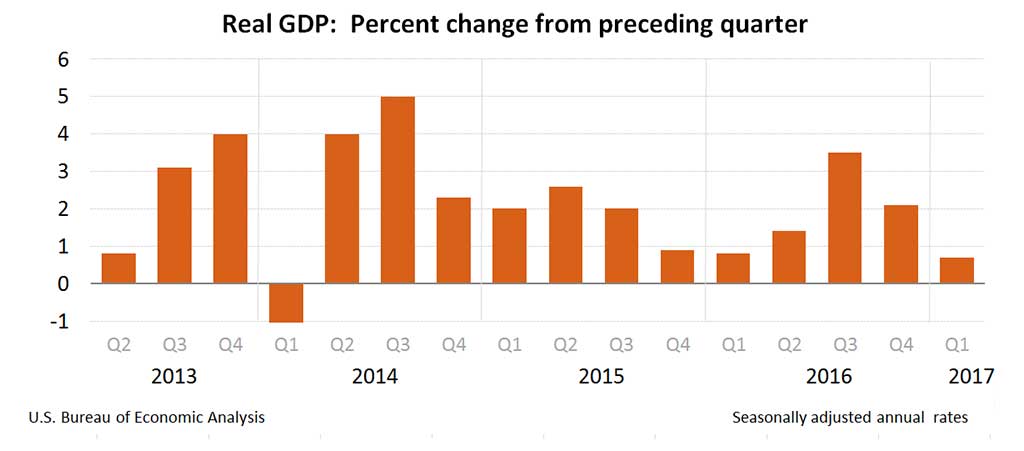

Newest GDP exhibits that the U.S. financial system stalls within the first quarter of 2017 with slowest progress in 3 years. The gross home product elevated at a meager 0.7% annual tempo within the first three months of the yr. The decelerate mirrored the weak point in client spending that’s prone to rebound within the coming months.

Client spending rose by solely 0.3 p.c, a steep drop from the three.5 p.c fee within the earlier quarter. MarketWatch reported: “The pullback in client spending is unlikely to final, although. People spent much less on gasoline, home-heating gasoline and garments after a spell of unseasonably heat climate in February—the second hottest on file. That’s unlikely to be repeated within the spring. Extra vital, family funds are in one of the best form in years amid file inventory market positive aspects, a robust labor market and progressively rising wages. People have more cash to spend and that’s mirrored by rising residence gross sales.”

Private saving was $814.2 billion within the first quarter, in contrast with $778.9 billion within the fourth. The non-public saving fee — private saving as a proportion of disposable private earnings — was 5.7 p.c within the first quarter, in contrast with 5.5 p.c within the fourth.