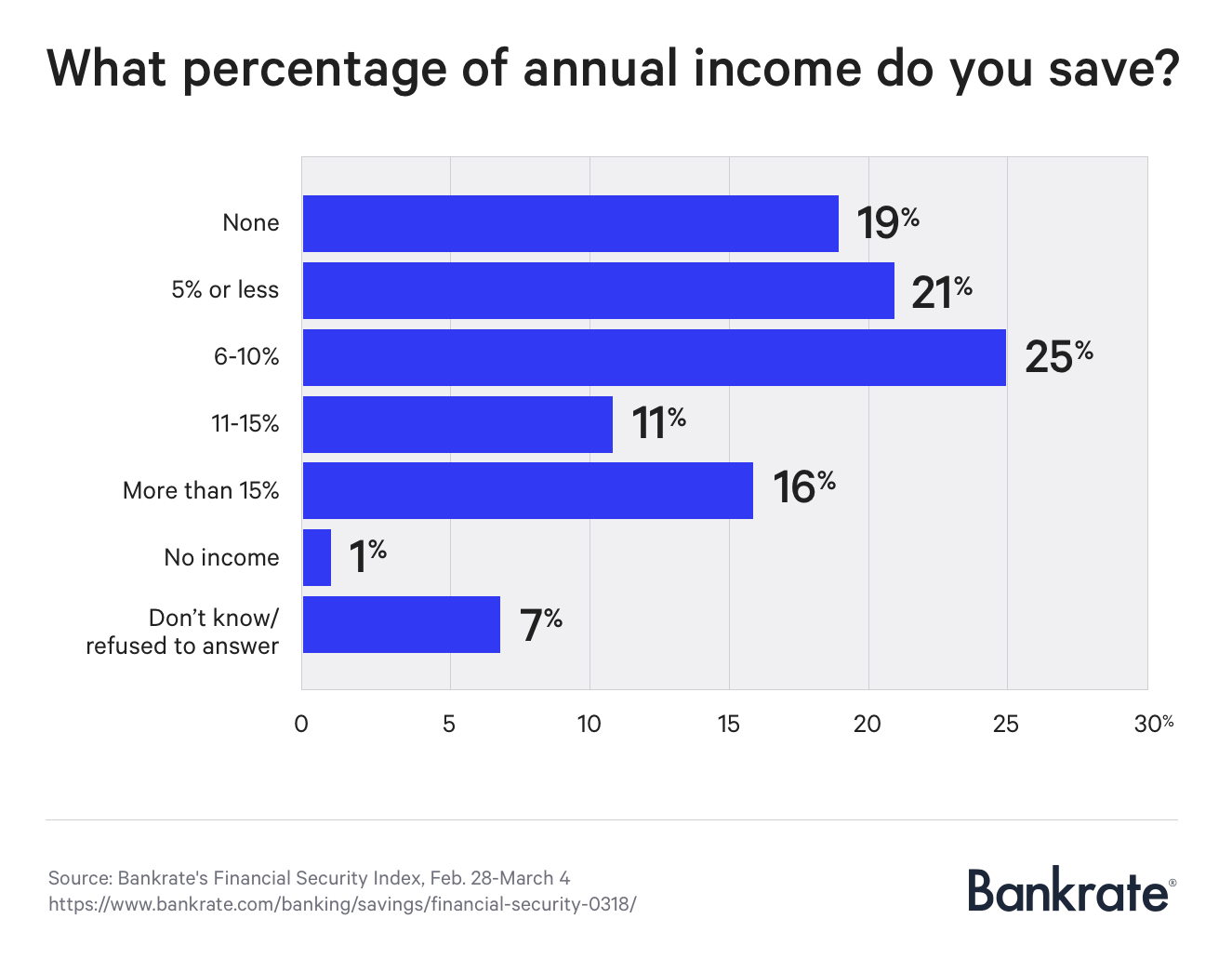

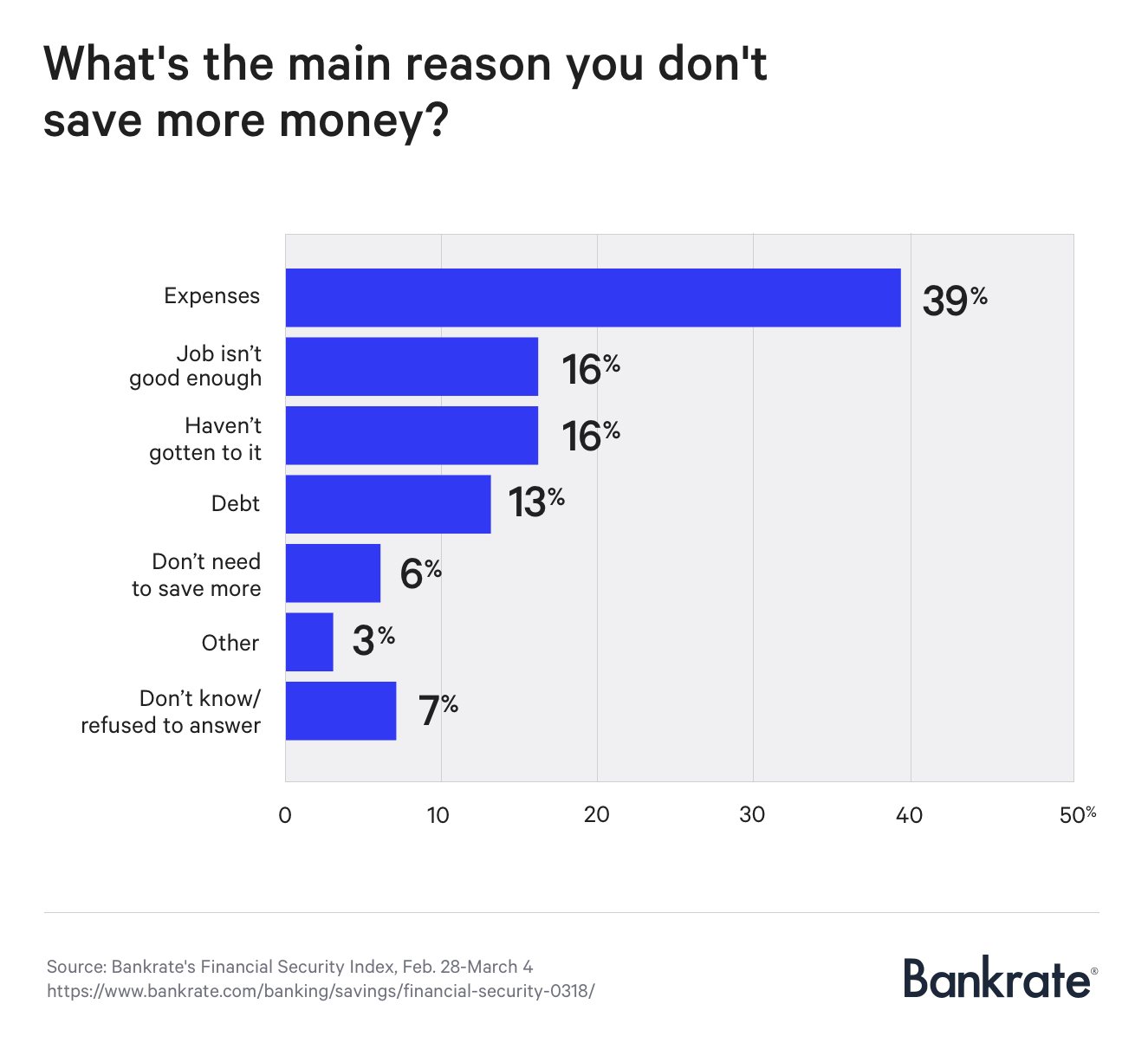

Regardless of a low unemployment fee and stronger economic system, 20 p.c of People don’t save any of their revenue in any respect and even those that do save aren’t placing away sufficient for retirement. In response to a new survey from Bankrate.com, one-fifth of People are including nothing to their financial savings. Amongst respondents, 2 in 5 cite life’s excessive bills, whereas one other 1 in 6 blame their crummy job.

“With a gentle, important share of the working inhabitants saving nothing or comparatively little, it’s just about assured that they’ll be unable to afford a modest emergency expense or finance retirement,” says Bankrate senior financial analyst Mark Hamrick. “That quantities to a monetary fail.”

Bankrate additionally stories that the common American has lower than $5,000 in a monetary account, 1 / 4 to a fifth of what it is best to have, and people aged 55 to 64 who’ve retirement financial savings solely carry $120,000 – which received’t final lengthy within the absence of paychecks.